I thought it might be good to cover a few questions I’ve had from clients and contacts this week. Topics maybe too small, possibly a bit random to put in a blog themselves, but interesting, nonetheless. This is the very first Questions on Wednesday! Let’s get started. This week, I write about paying your self assessment tax, “K” tax codes and changing your Limited Company name.

How do I pay my self assessment tax bill?

The dreaded 31st of January is nearby. Whilst the government announced penalties for late filing won’t be issued until after February, they still expect payment. Any taxes not paid by the 31st of January will incur interest.

HMRC give you several ways to pay.

Our preferred option is to log into your personal tax account. With this you can immediately pay your bill here using your debit card. What is good about this, is you see your payment pending straight away. If you don’t have a personal tax account, it’s worthwhile getting one of these for many reasons.

Online banking is another easy way. Make sure to include your UTR, plus the letter “K” as your reference. For example, if your UTR is 1234567890, your banking reference would be 1234567890K.

Direct debit is another option, but you set this up for one payment only, so it doesn’t quite work how you would expect a direct debit would.

An interesting option is to have your tax taken through your tax code. This means they will adjust your pay over the next 12 months. Your bill must be under £3,000, you need to be employed or have a company pension and have filed your tax return by the 30th of December online. There are a few other conditions here so I would always check with HMRC you’re okay to have taxes taken out this way.

Remember, if you are struggling to pay, contact HMRC before the 31st to discuss a time to pay arrangement with them. Visit our COVID-19 page for a little more on the time to pay arrangements HMRC are offering.

What is a “K” tax code?

I was contacted to ask what a “K” tax code means on a pay slip the other day. Tax codes are identifiers on payslips to highlight how much personal allowance someone should be entitled to. There are all kinds of tax codes, but in short, a K tax code is a negative tax code and means you have a ‘negative’ tax allowance.

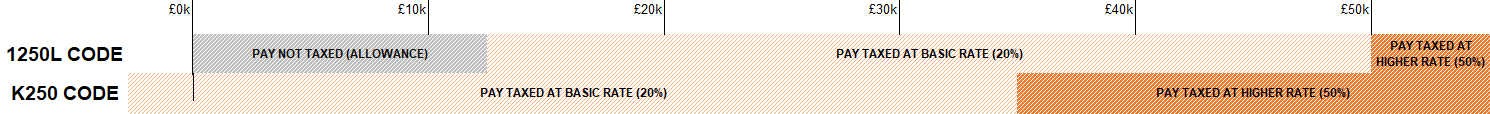

You will most likely receive a K tax code if you have untaxed income, particularly benefits in kind like a company car and have exhausted your personal allowance. Below is an example I’ve drawn up, for someone earning £55,000 (based on the 20/21 tax year).

If you had a 1250L code, you would get your basic allowance and would find £37,500 of your salary taxed at basic rate. Only £5.000 is taxed at higher rate. With a K250 code, this is effectively a negative allowance. The K code is ‘dragging’ the 20% starting point for your income left of the £0k mark. The diagram below highlights the negative allowance coming into play. Because your basic rate ‘starts’ at -£2.500, it means you begin paying 40% for much more of your salary than normal.

To put this in perspective, the amount of tax paid with the tax code 1250L is £9,500, whereas if you had tax code K250, you would pay £15,500.

If you have a K tax code and don’t believe it is right, contact HMRC to check. One other thing; even if you have a high K code, a regulatory limit means you cannot be taxed more than 50% of your pay. By the way, if you need to pull together a self assessment tax return, all your income, benefits and tax paid is factored in. This ensures you are correctly taxed regardless of the code applied.

How do I change the name of my Limited Company?

If you decide you want to change your limited company, you need to hold a special resolution. This is to get agreement from the shareholders to make the change. Once this is done, the change is executed by completing form NM01 online. It will cost £8 to file, £30 if you are after a same day service. If your articles allow, you can make a change using form NM04.

As long as your new name is available, does not have any trademark issues or is deemed inappropriate, that is the relatively easy bit. You then need to inform all the stakeholders of your business. Consider the following:

- HMRC – they will usually be made aware for Corporation Tax purposes of the change, but they need to be informed for other taxes, such as VAT and PAYE

- Suppliers – ensuring invoices are correctly addressed to your new business

- Customers – keep them informed, ensure the change won’t backfire for any reason with them

- Banks – make sure banks are aware of your new details

- Statutory registers – you have a legal obligation to keep these updated or risk facing a fine

- Domains – your website and emails, check your desired domain is available before you change your company name too

- Branding – new logos, design and so on

We underwent this very process as a business and found the administrative burden is the biggest headache. Do consider whether a name change is worth it.

If you have any queries about anything above, or even have some topics you would like me to talk about, please get in touch today.