Record keeping – the bane of running a business for many.

We get it. After a busy day of work, the last thing you want to do is sit down to tackle that dreaded admin, but it is incredibly important. Also, we’ve found that just getting into good habits, building and using systems turns it into a breeze.

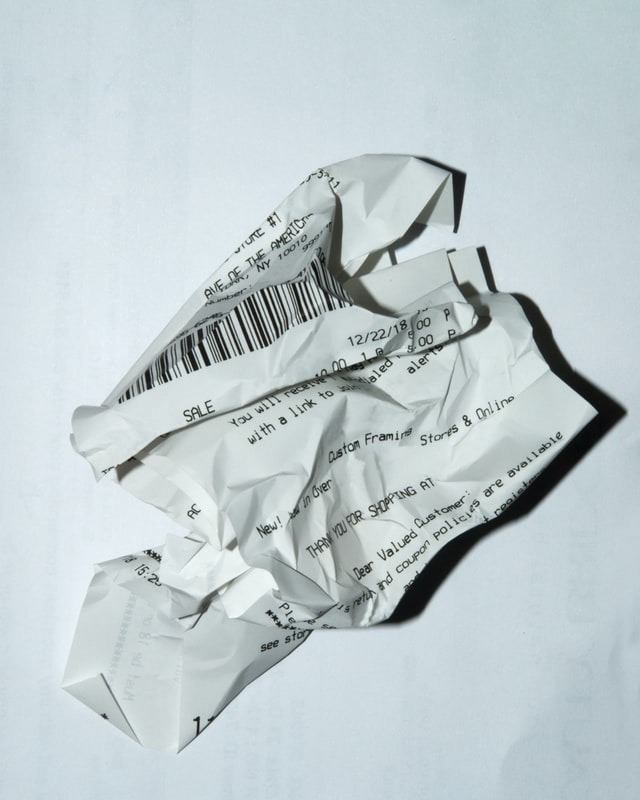

So, if you have receipts in the footwell of your van, unwieldy bank accounts, and an accountant on your case every day, read on.

Why is it important?

Five words. Her Majesty’s Revenue and Customs. They are very explicit about this.

Yes, keeping an eye on your records will give you a greater view of how your business is running and support the accounts preparation. But let’s be honest. It’s all about tax. Your goal with good record keeping is to make sure you have all your paperwork to hand, so you can validate your income and expenses and justify the amount of tax you pay. Quite simply put, if you have no trail of your paperwork, it becomes very difficult to justify recovering VAT or reducing your corporation tax.

You should keep details about the following:

- All of your income and sales, including invoices

- All of your expenses

- PAYE & VAT reports and all supporting documents

- Personal income details, from anything such as P60s to property rental income

- Details of grants claimed, such as SEISS (Self Employment Income Support Scheme)

On the face of it, this is a heap of paperwork. But with these systems and tools in place, you’ll be able to pull everything together easily.

Important – VAT receipts

A little point on VAT receipts, particularly for VAT registered businesses.

The credit card payment slips, order confirmations, or delivery notes won’t cut it, you need a VAT receipt in order to recover VAT. It should contain a few key details, such as:

- The seller’s name

- Their VAT registration number

- The date of the transaction (sometimes also known as the tax date, but there are times when these can be different dates)

- A description of the supply

- Details of the amount paid and any VAT paid on top of it

If you are given a receipt that isn’t clearly giving you that information, ask for it.

Tip 1 – going digital is a must

The very first thing you must do is go digital. You should get the digital systems in place which will in turn create or store these key records so you can master your recordkeeping. It’s easier than it sounds.

- Get an online cloud accounting software, such as QuickBooks or Xero.

- Use a receipt capturing tool – QuickBooks and Xero use their own tools but we’re quite big fans of Dext (formerly ReceiptBank) at the moment.

Business owners who are VAT registered continue to have their hands forced owing to MTD (Making Tax Digital) to use these tools, but even if VAT is not an issue for you, it’s really worth investing in cloud accounting software. It can act as the hub for your key records and will be the basis of your financial statements and taxes. Underpin it by syncing in your business bank account as well to get a regular, relevant feed of activity into the software.

Receipt capturing tools help automate and simplify the bookkeeping. You can snap a picture of your receipts, or even digitally email them across if they come via email and the software can help read and categorise the content ready to go into your bookkeeping.

Tip 2 – but keep a backup!

Yes, the digital revolution is here, we’re all for that and HMRC has said you don’t need to keep those paper copies. If you have a digital image, that’s fine as far as they are concerned.

But – we always, always recommend keeping a back-up. As much as these accounting systems and receipt capture tools are leveraging top-of-the-line hosting packages from the likes of Microsoft and Amazon, there always remains a risk that the data could become lost or destroyed from anything such as a targeted hack to a natural disaster destroying their servers. The likelihood is minuscule, but we’re talking about your business, so it’s always worth keeping a backup.

A more likely issue could be that the image you took on Dext looks awful, but by the time you realise this you’ve scrunched the paperwork up and it’s in a bin miles away somewhere.

We recommend something simple. Buy a monthly expanding file and stick your receipts in there. Failing that, even the humble shoebox will do. Hopefully, you’ll never need to root around in it, but you know it’s there, just in case…

Tip 3 – get into a rhythm

Make a foolproof system so you just get these receipts captured straightaway. Something quick and easy. Our process is this.

- Purchase something

- Get the receipt

- Capture receipt in Dext

- Put in a plastic wallet in my car/pocket in my coat until I’m home ready to put it in my folder

That’s it.

Simple, but the idea is I’m getting these things captured straight away and I’ll never forget or miss them off.

Your method could be to pile them up, get home, lay them across the dining room table every night, and snap the lot. The key is to build a consistent, simple system so you do it regularly and quickly, whilst it’s fresh in your mind.

Tip 4 – use the business bank for everything

Your business bank account is your friend. Using the business bank account to keep on top of your records will help you immeasurably.

By running everything through the business bank, you all-of-a-sudden have a list built up of everything going in and out. This is incredibly important for other reasons I’ve covered before, but it will also help you keep tabs on your records by allowing you to cross-check your paperwork with what you’ve spent.

Using cash does the complete opposite. You will have no audit trail unless you decide to complete a cash log, which will take you all sorts of time to maintain. Do try to go cashless – the world is ready for it now.

If a stubborn supplier or customer insists on cash only, really consider if they’re worth doing business with. They are in the minority these days.

Tip 5 – try to digitise your receipts

Shops like Screwfix and Argos now offer digital receipts. You can purchase at the store and even if you don’t have an account, they can take an email address and send receipts straight there.

The more you can work with suppliers like this, the simpler the process will be. These receipts can then be forwarded as an email to your receipt capture system. Dext handles this effortlessly.

Want to be super streamlined? Why not set up an inbox rule, so every time you get an email from a certain supplier containing a receipt, it forwards it to Dext straightaway? You need to be explicit with the logic enough so it doesn’t send everything across, but also recognises when it’s a receipt you’ve received.

Bonus tip – consider a bookkeeper

A good bookkeeper is going to tidy everything up for you. They will nudge you for missing paperwork, allocate all your transactions correctly and save you the job of keeping on top of everything, and will only point out things that need your attention.

If you have tips 1 to 5 in place, your bookkeeper will be able to support you effectively. It will still save you time, even if your system is super slick, plus they’ll help with the accounting and making sure everything is lined up in the right place.

However, if you are not, their job will become difficult, to the point they either cannot provide you value, or it’ll cost you an arm and a leg to help them do their job.

It’s easy to take shortcuts. It’s easy to ‘assume’ an expense might have VAT on it. But who do you want to be if HMRC comes knocking? The person scrambling about the back of their van for that receipt HMRC are looking for, surrendering hundreds if not thousands of pounds worth of tax and penalties? Or the person who has everything lined up, clean, and easy to review?

Want to revolutionise your recordkeeping? Or thinking of support for your books? Reach out to us today to see how we can help.